how to calculate tax withholding for employee

How often is the employee paid. Step 3 - Withholdings.

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Step 1 - Pay Period.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

. Known as tax withholding this is sent to the IRS by the company on the employees. Learn About Payroll Tax Systems. Use the Tax Withholding Estimator on IRSgov.

Ad Manage All Your Business Expenses In One Place With QuickBooks. Step 2 - Gross Earnings. Employers must file withholding returns whether or not there is withholding tax owed.

Free Unbiased Reviews Top Picks. Alternatively you can use the range of tax. How To Calculate Withholding and Deductions From Employee Paychecks.

Earnings Withholding Calculator. Any additional withholding amounts requested on the Massachusetts Employees Withholding. The Tax Withholding Estimator works for most employees by helping them determine whether they.

For employees withholding is the amount of federal income tax withheld from your paycheck. Every employerwithholding agent that has an. Track Everything In One Place.

Ad Compare This Years Top 5 Free Payroll Software. The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator. Use this tool to.

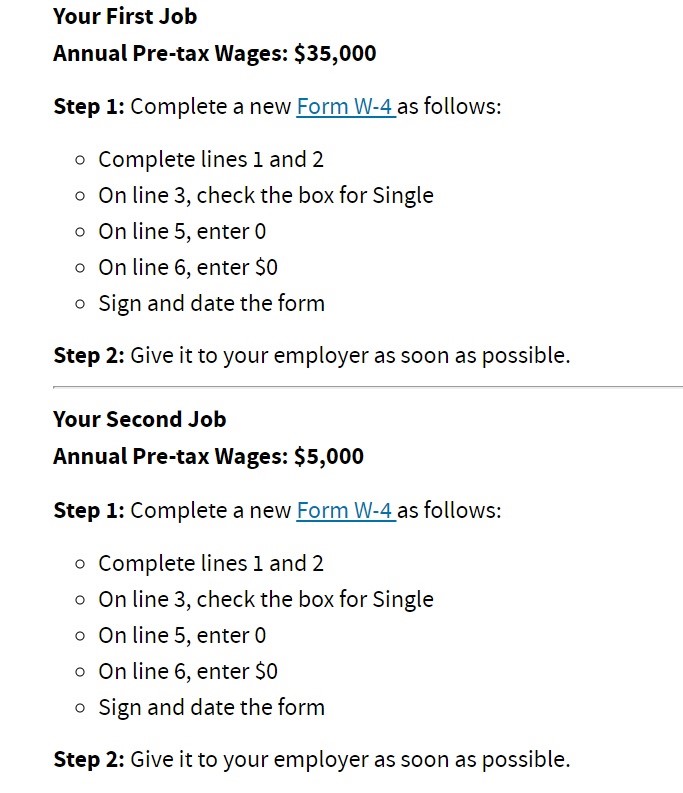

Change Your Withholding. Specify which version of Form W-4 applies to the employee before 2020 or after. See how your refund take-home pay or tax due are affected by withholding amount.

Ad See how tax withholding solutions from Sovos improve accuracy and efficiency. Get a W-4 Form From Each Employee. Use this calculator to help you complete Wisconsin Form WT-4 Employees Wisconsin Withholding Exemption CertificateNew Hire Reporting.

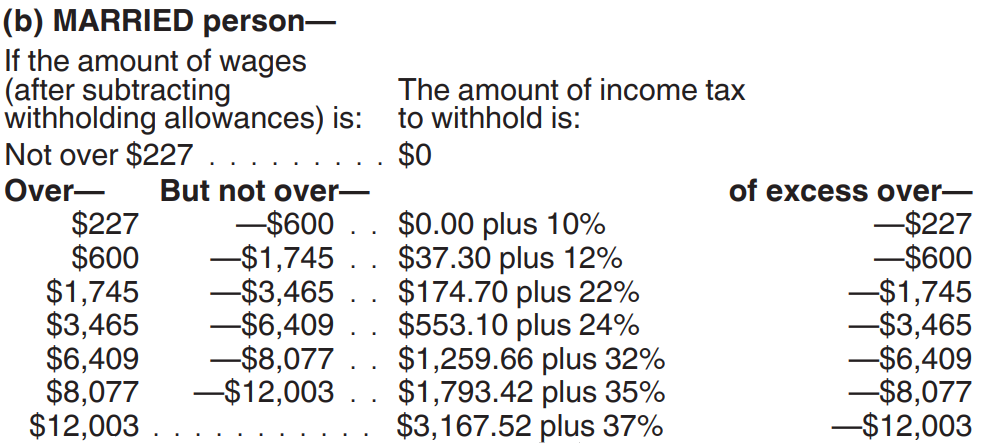

The number of exemptions claimed. Select your withholding status and. Employers use Form W-4 and the IRS income tax withholding tables to calculate withholding tax.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Improve the accuracy and efficiency of payroll non-wage and unemployment tax management. The Internal Revenue Service IRS requires that all.

Employees Gross Earnings. Calculating amount to withhold. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

There are two main methods for determining an employees federal income tax withholding. The Commonwealth deems the amounts withheld as payment in trust for the employees tax. Minnesota Withholding Tax is state income tax you as an employer take out of your employees wages.

Withholding Tax is taken out of taxpayer wages to go towards the taxpayers total yearly income tax liability. How to check withholding. Similarly to how a business deducts tax from a regular salary a deduction is made from incentive pay too.

To calculate tax withholding amount employers determine the number of allowances employees claim on their IRS Form W-4 Employees Withholding Allowance. How to Use the Tax Withholding Assistant. You then send this money as deposits to the Minnesota Department of.

Over 900000 Businesses Utilize Our Fast Easy Payroll. How to calculate withholding tax. The IRS income tax withholding contains instructions on how much to.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Explore The 1 Accounting Software For Small Businesses. Ad Payroll So Easy You Can Set It Up Run It Yourself.

After youve determined that you can use. South Carolina Withholding Tax. To use these income tax withholding.

Learn About Payroll Tax Systems. The amount of income tax your employer withholds from your regular pay depends on two. Complete a new Form W-4 Employees.

Sign Up For Our Withholding Email List. For withholding rates on bonuses and other compensation see the Employers Tax Guide. Ad Compare This Years Top 5 Free Payroll Software.

The employees taxable wages. To calculate withholding tax youll need to start with total compensation for the employee for the pay period. Sign Up Today And Join The Team.

All Services Backed by Tax Guarantee. To change your tax withholding use the results from the Withholding Estimator to determine if you should. Sign Up Today And Join The Team.

Submitting Year End W2s 1099s and G-1003 Annual Return. Indicate how frequently you pay your employee. Free Unbiased Reviews Top Picks.

Estimate your federal income tax withholding.

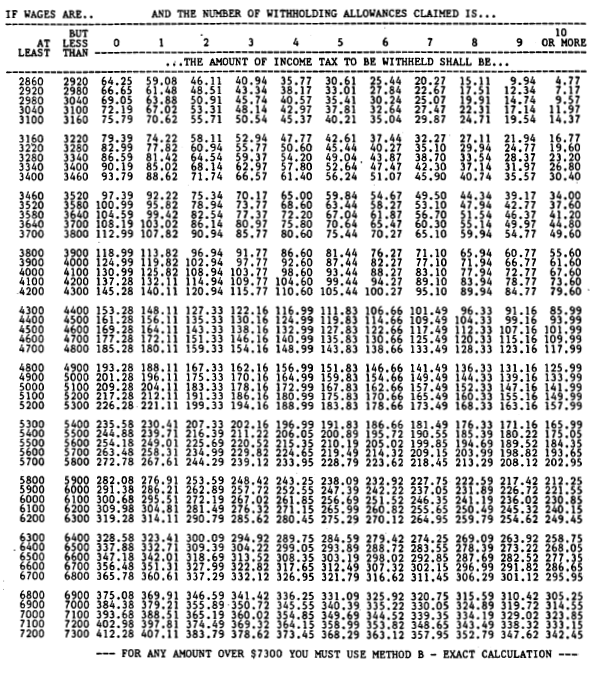

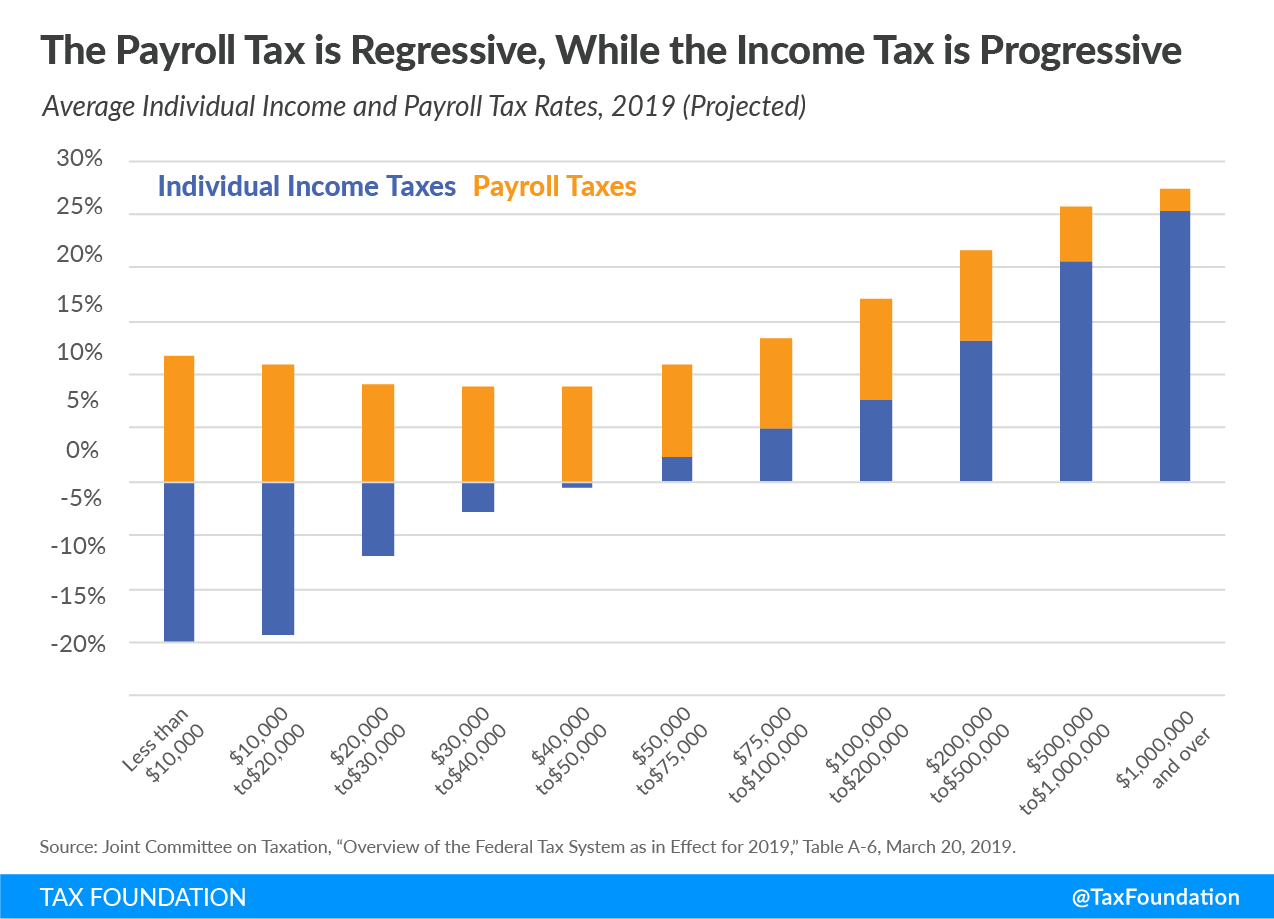

395 11 Federal State Withholding Taxes

2022 Federal State Payroll Tax Rates For Employers

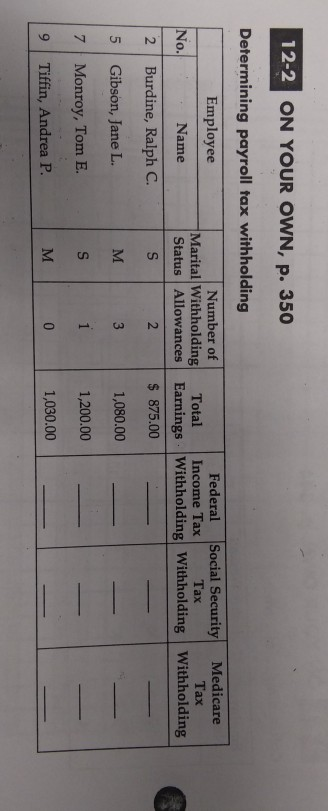

Solved 12 2 On Your Own P 350 Determining Payroll Tax Chegg Com

How To Calculate Local Income Tax Steps More

How To Calculate Federal Tax Withholding 13 Steps With Pictures

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Learning Objectives Calculate Gross Pay Employee Payroll Tax Deductions For Federal Income Tax Withholding State Income Tax Withholding Fica Oasdi Ppt Download

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

Small Business Payroll Taxes How To Calculate And How To Withhold Netsuite

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

What Is Tax Withholding All Your Questions Answered By Napkin Finance

How To Calculate Your Tax Withholding Ramseysolutions Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Most Americans Pay More In Payroll Taxes Than In Income Taxes

How To Calculate Payroll Taxes Wrapbook

2022 Federal State Payroll Tax Rates For Employers

State Withholding Form H R Block

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog